Pendokong Wang Dinar dan Dirham Di Peringkat Awal....

Kelantan state government has issued a gold dinar and silver dirham on Thursday and plans to give employees the option of receiving part of their salary in this currency, as well as introduce gold bars for large investments. Muslim alms can also be paid with the coins. Malaysia Deputy Finance Minister Datuk Dr Awang Adek Hussin in commenting on the move was reported to have said that under the law, currency matters came under the purview of the federal government and Bank Negara Malaysia (BNM). He added that the Finance Ministry and BNM would be studying the action that could be taken regarding the matter.

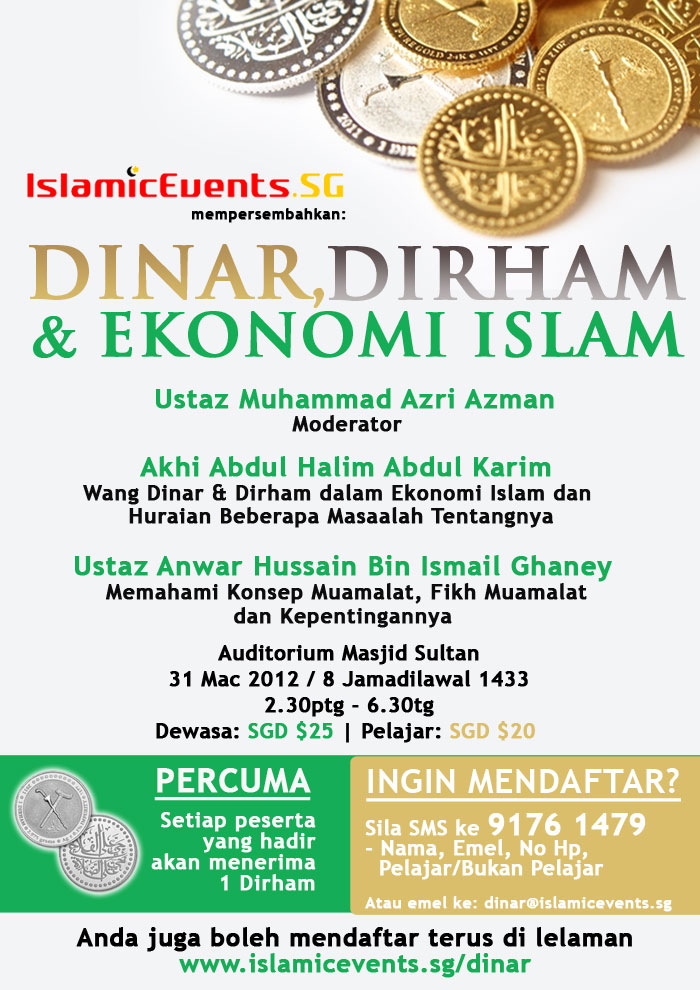

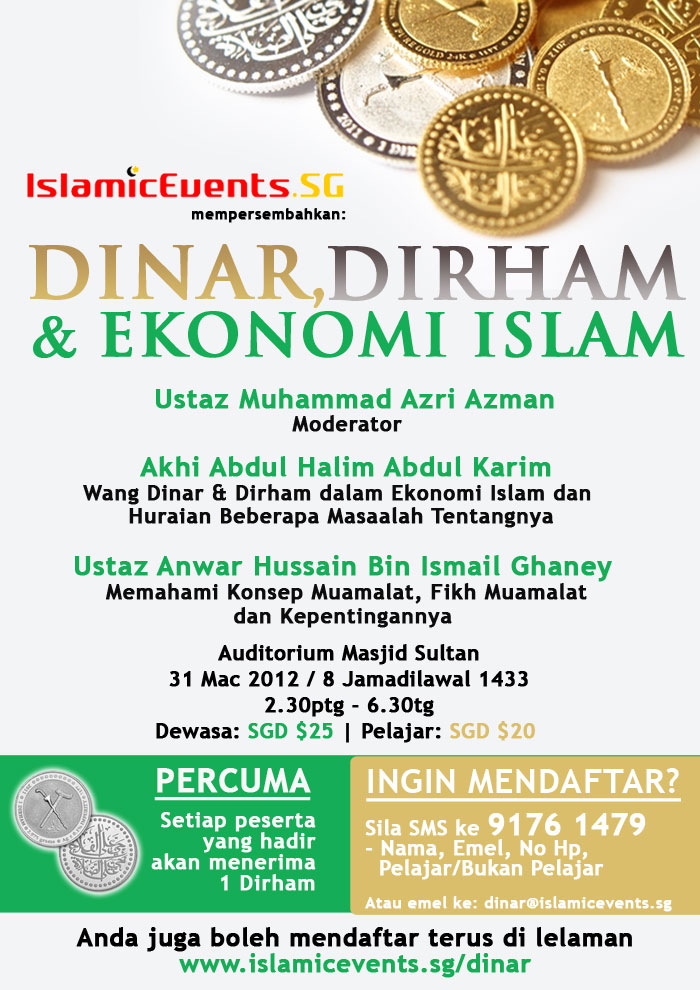

Photo by Malaysia Star: New Dinar and Dirham Kelantan

Photo by Malaysia Star: New Dinar and Dirham Kelantan

The gold dinar was the official currency of Muslim societies for centuries. The value of the coins used in Kelantan can fluctuate according to market prices, but officials say it remains a better alternative to currency affected by the U.S. dollar and other foreign currency. Kelantan authorities also say the use of such coins is encouraged in the Quran. State officials have produced coins worth about $630,000 for use at about 1,000 outlets in Kelantan's capital, said Nik Mahani Mohamad, executive director of Kelantan Golden Trade, which mints the coins.

"It's a great, great moment for Muslims," Nik Mahani said. "We are providing an alternative means for the people to trade with."

The coins came into circulation Thursday and can be purchased at various locations in Kelantan. Their worth is currently about US$180 per dinar and US$4 per dirham. But the plan hit a snag when Malaysia's central bank said in a statement later Friday that the ringgit remained the only currency that is the legal tender for payment of goods and services in Malaysia. The bank said it has the sole right under the law to issue currency in Malaysia. It was not immediately clear how the bank planned to block the use of the coins for transactions.

Photo by World Islamic Mint: 8 Dinars

Photo by World Islamic Mint: 8 Dinars

The Kelantan Government denied that its gold dinar and silver dirham will be made a second currency in the state. State Economic Planning, Finance and Welfare Committee chairman Datuk Husam Musa said the syariah currency instead was seen as an alternative for use in the barter trade system.

"Several news report about the dinar being Kelantan's second currency are not accurate and have caused confusion. I do not see why this issue has to be blown up following Kelantan introducing the use of the dinar, as it has been around since the beginning of Islam," he told reporters here.

The gold dinar and silver dirham is managed by Kelantan Gold Trade (KGT), a subsidiary of Kelantan Mentri Besar Incorporated (PMBK). In a symbolic gesture, Nik Abdul Aziz handed over a dinar gold to PMBK chief executive officer Mustapha Salleh as payment of salaries to PMBK employees for the month. Nik Abdul Aziz said 1,000 traders so far had agreed to use the currency in their transactions besides Tabung Haji and Bank Islam Malaysia.

Photo by World Islamic Mint: 10 Dirham

Photo by World Islamic Mint: 10 Dirham

I support the move on using Gold Dinar and Silver Dirham as a form of salaries payment. I just cannot accept that this good thing been politicize. You can read more at their official website

World Islamic Mint. I am not sure who is saying no to this gold coin; most international news says it is BNM but from what I read in Bernama, it is by Deputy Finance Minister.

Source: Bernama, AFP, Malaysian Star.